Get a mortgage with CCJs

Some mortgage companies will not take on people with CCJs registered against them. However, some lenders are prepared to overlook CCJs particularly if they relate to a past relationship breakdown, or a previous period of unemployment.

Some banks and building societies approach applicants with impaired credit history on a case by case basis, while a number of specialist lenders will take on prospective borrowers who have had CCJs, but charge higher interest rates for the privilege.

As a specialist non standard mortgage broker, we have access to lenders who look at each case on an individual basis. We have a solid track record of helping people get a mortgage who have had CCJs registered against them. Simply request a free, no obligation mortgage quote from us and we'll let you know whether we think we'll be able to help you.

Some lenders offer borrowers an alternative, known as a credit repair mortgage. These work by providing borrowers a mortgage at a rate which is more expensive to begin with. Following a period of between one and three years, if the borrower has made timely repayments they will be given the opportunity to switch to a standard rate without needing to remortgage.

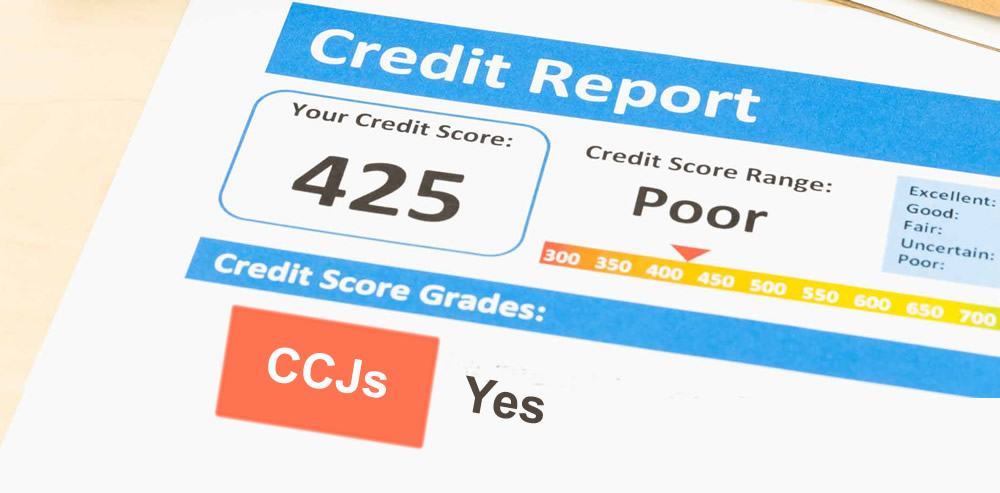

A CCJ is a judgment from the County Courts (in England and Wales) against an individual. CCJs are issued against an individual usually as a result of them failing to meet contractual obligations with regard to payments to a lender, firm or individual.

Many people are unaware they have a County Court Judgement (CCJ) recorded against their name until an application for a mortgage is declined and the matter comes to light. For example, a small unpaid mobile phone bill which has been overlooked, could result in a CCJ being issued against a person without them knowing because the company has been unable to trace them to arrange settlement due to a change of address.

The creditor (the person or organisation who is owed money) must have issued a default notice before being able to apply to the court for a CCJ to be issued.

CCJs in numbers

Figures from the Registry Trust, the non-profit body that monitors county court judgements, reveal 320,494 County Court Judgments (CCJs) were issued against consumers in the first half of 2020 in England and Wales. The average value of CCJs was £1,768. The CCJ statistics are a stark reminder that there are still many people who have experienced a blip on their credit rating who will need the expert help of a mortgage adviser to point them in the direction of those lenders who may be able to assist.

Specialist lenders could offer salvation

Traditional lenders tend to be very skeptical about anyone who has a CCJ listed on their credit report, taking the stance it is an indication the person may prove to be an unreliable borrower. On the other hand specialist lenders adopt a slightly different viewpoint. For these lenders the door is open, they won't be spooked just because there is a CCJ listed on your credit report. Timing plays an important role, if your CCJ was issued over 3, 4 or 5 years ago you and since then you have been on the straight and narrow, your chances are more favourable than if the CCJ was issued more recently.

Get a FREE quote and expert advice

Simply complete the enquiry form to get a FREE initial no obligation quote from a mortgage broker who specialises in assisting people with CCJs or impaired credit history.